Best News | This years Best News Treats and Viral Events

Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future

Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future

In today's uncertain economic climate, "Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future" published in 2023, is a crucial guide for those planning for their golden years. This comprehensive resource provides valuable insights and strategies to help you maximize your retirement savings and secure a comfortable future.

Editor's Note: "Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future" has been published today as a response to the growing need for retirement planning guidance. With its expert analysis and practical advice, this guide empowers individuals to make informed decisions about their financial future.

After extensive research and analysis, we have compiled this comprehensive guide to provide you with the essential information and strategies you need to optimize your retirement savings. By leveraging the expert insights and actionable advice contained within, you can make informed decisions that will help you achieve your retirement goals and secure a brighter financial future.

Key Differences:

| Traditional Retirement Planning | Retirement Revaluation Strategies |

|---|---|

| Focuses on maximizing savings contributions | Emphasizes asset allocation and risk management |

| Limited investment options (e.g., stocks, bonds) | Incorporates alternative investments (e.g., real estate, commodities) |

| Assumes a linear retirement timeline | Accounts for potential market fluctuations and longevity risk |

By adopting Retirement Revaluation Strategies, you can:

FAQ

Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future offers practical guidance to maximize retirement security, but common questions may arise. This FAQ section addresses frequently encountered concerns and provides concise, informative answers to empower retirement planning.

Question 1: How can I catch up on retirement savings if I've started late?

Answer: Implementing catch-up contributions to retirement accounts, utilizing catch-up IRAs, and seeking professional financial advising can help accelerate retirement savings efforts.

Question 2: Is it too late to start saving for retirement in my 50s?

Answer: Saving for retirement at any age is crucial. While starting later may limit accumulation, every effort made now can significantly impact retirement outcomes.

Question 3: Should I prioritize contributing to a Roth IRA or a traditional IRA?

Answer: Choosing between a Roth IRA and a traditional IRA depends on current income and long-term retirement goals. Consulting with a financial advisor can help determine the most suitable option.

Question 4: How much of my income should I save for retirement?

Answer: The appropriate retirement savings percentage varies based on individual factors, such as age, income, and financial obligations. General guidelines suggest saving a minimum of 10-15% of gross income.

Question 5: Should I adjust my retirement savings strategy during economic downturns?

Answer: During economic downturns, it's crucial to maintain or increase retirement contributions as possible. Market fluctuations can present buying opportunities at lower prices, benefiting long-term retirement goals.

Question 6: How can I avoid common mistakes in retirement planning?

Answer: Seeking professional financial guidance, understanding fees and tax implications, and avoiding emotional decision-making can help mitigate common retirement planning pitfalls.

Understanding these aspects empowers individuals to make informed decisions and navigate retirement planning effectively.

Explore our comprehensive guide Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future to delve deeper into these strategies and gain valuable insights for a secure retirement.

Tips

To ensure a secure retirement plan, individuals should consider implementing effective revaluation strategies. Here are several tips to help optimize retirement savings:

Custom Essay | amazonia.fiocruz.br - Source amazonia.fiocruz.br

Tip 1: Regularly Review Retirement Goals

Reassess retirement needs and goals periodically to ensure alignment with current financial circumstances and lifestyle aspirations. Adjust savings contributions and investment strategies accordingly.

Tip 2: Max Out Retirement Contributions

Utilize tax-advantaged retirement accounts, such as 401(k)s and IRAs, to the fullest extent possible. Contributions to these accounts reduce current taxable income and accumulate tax-deferred or tax-free growth.

Tip 3: Diversify Retirement Investments

Spread investments across various asset classes, such as stocks, bonds, and real estate, to mitigate risk and enhance potential returns. Rebalance the portfolio over time based on changes in market conditions and risk tolerance.

Tip 4: Consider Target-Date Funds

Target-date funds offer a convenient option for automatic diversification and rebalancing. These funds adjust asset allocation based on the investor's expected retirement age, gradually shifting towards more conservative investments as the target date approaches.

Tip 5: Explore Alternative Investments

In addition to traditional investments, consider exploring alternative options such as private equity, real estate, or commodities. These investments can provide diversification and potentially enhance returns, but also carry higher risks.

Tip 6: Seek Professional Advice

Consult with a financial advisor to develop a tailored retirement plan that considers individual circumstances, risk tolerance, and investment objectives. Professional guidance can help navigate complex financial decisions and maximize retirement savings potential.

By implementing these strategies, individuals can optimize their retirement savings and work towards a secure and fulfilling retirement.

Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future

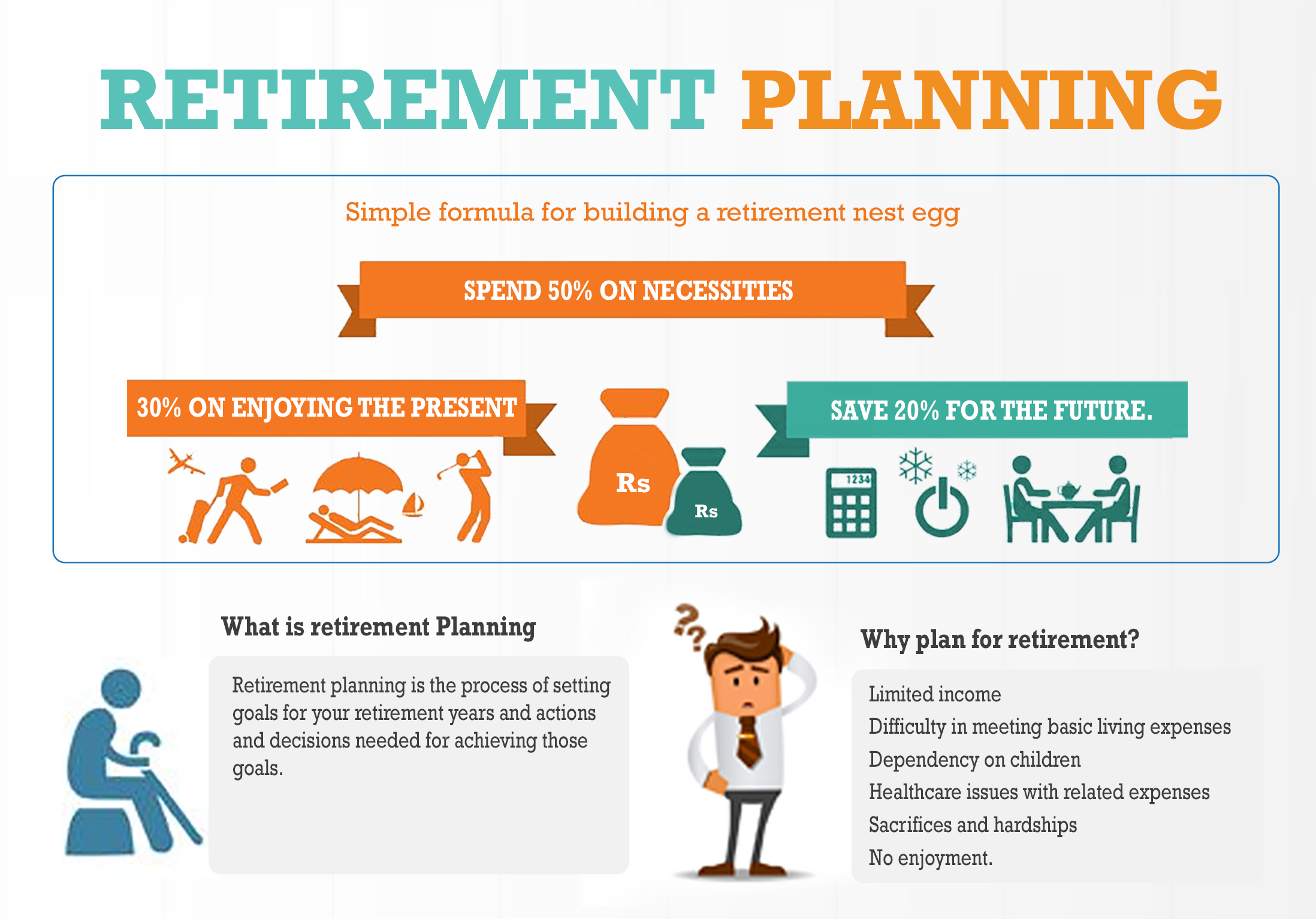

Preparing for retirement requires careful planning and strategic revaluation to ensure financial security during your golden years. By optimizing your retirement savings, you can build a solid financial foundation and enjoy a comfortable and fulfilling retirement.

- Diversify Investments: Spread your savings across various asset classes, such as stocks, bonds, and real estate, to mitigate risk and enhance returns.

- Regular Contributions: Establish a consistent savings plan and contribute regularly, even small amounts, to build your retirement nest egg over time.

- Tax-Advantaged Accounts: Utilize tax-advantaged retirement accounts, such as 401(k)s and IRAs, to reduce taxes on investment earnings and grow your savings faster.

- Rebalance Portfolio: Periodically review and adjust your investment portfolio to maintain an appropriate balance between risk and potential returns in line with your age and risk tolerance.

- Consider Inflation: Factor in inflation when planning your retirement savings to ensure your nest egg will maintain its purchasing power over time.

- Seek Professional Advice: Consult with a financial advisor to develop a customized retirement plan that aligns with your specific needs and goals.

Maximizing Your Retirement Savings with a Health Savings Account (HSA - Source thefinancedream.com

These key aspects of retirement revaluation strategies are essential for building a secure financial future. By implementing these strategies effectively, you can optimize your retirement savings, mitigate risks, and set yourself up for a comfortable and fulfilling retirement.

Optimize Your Retirement Savings: Retirement Revaluation Strategies For A Secure Future

Retirement planning is a multifaceted endeavor that requires careful consideration of various factors, including savings strategies, investment choices, and risk management. Among these, retirement revaluation plays a crucial role in ensuring the sustainability and growth of retirement savings and investments over time. Retirement revaluation involves periodically assessing and adjusting one's retirement savings and investment portfolio based on changing circumstances, market conditions, and personal financial goals. It is an essential aspect of retirement planning that can help individuals optimize their savings, mitigate risks, and increase the likelihood of a secure financial future in their retirement years.

5 Ways Business Owners Can Optimize Retirement Savings — HFM Investment - Source hfmadvisors.com

Regular retirement revaluation allows individuals to make informed decisions about their savings and investments, taking into account factors such as inflation, market volatility, and personal financial needs. By proactively adjusting their portfolio, they can reduce the impact of market downturns, capitalize on growth opportunities, and ensure that their savings are aligned with their evolving financial goals. Retirement revaluation also enables individuals to address changes in their personal circumstances, such as changes in income, health status, or family responsibilities, and make necessary adjustments to their savings and investment strategies.

Understanding the importance of retirement revaluation is crucial for securing a stable and comfortable retirement. By periodically reviewing and adjusting their retirement savings and investments, individuals can proactively manage risks, maximize potential returns, and increase the likelihood of achieving their long-term financial goals. This proactive approach not only helps individuals navigate the challenges of retirement planning but also provides peace of mind, knowing that their financial future is in their hands.

There are several key considerations when undertaking retirement revaluation. Firstly, individuals should evaluate their savings goals and risk tolerance, taking into account their age, income, and investment horizon. This assessment helps determine the appropriate asset allocation and investment strategy for their portfolio. Secondly, individuals should regularly monitor market conditions and economic indicators to make informed decisions about their investments. Thirdly, they should consider consulting with a financial advisor or retirement planner for personalized guidance and support in developing and executing their retirement revaluation strategies.

Conclusion

Retirement revaluation is an integral part of effective retirement planning, ensuring the sustainability and growth of retirement savings and investments over time. By periodically assessing and adjusting their retirement savings and investment portfolio, individuals can mitigate risks, capitalize on growth opportunities, and align their savings with their evolving financial goals. This proactive approach not only helps individuals navigate the challenges of retirement planning but also provides peace of mind, knowing that their financial future is in their hands.

As circumstances change throughout an individual's working life and retirement, regular retirement revaluation becomes even more crucial. Individuals should periodically review their savings goals, risk tolerance, and investment strategy to ensure they remain aligned with their financial objectives. By embracing retirement revaluation as an ongoing process, individuals can increase the likelihood of achieving a secure and comfortable financial future in their retirement years.